The housing loan sector has witnessed robust growth over the last decade and this growth has also changed the home loan approval requirements and process.

Today, the CIBIL score for home loans is an integral part of the home loan approval process. In this brief article, we discuss what CIBIL score is and what role it plays when you take a home loan.

CIBIL Score Explained

The Reserve Bank of India has authorized four credit information agencies in India. These agencies collect information on how individuals use credit and repay it and based on the information provided, they assign a score to all credit users called the CIBIL Score.

The CIBIL score for home loans is important as it helps lenders correctly assess the risk in doing business with a credit user.

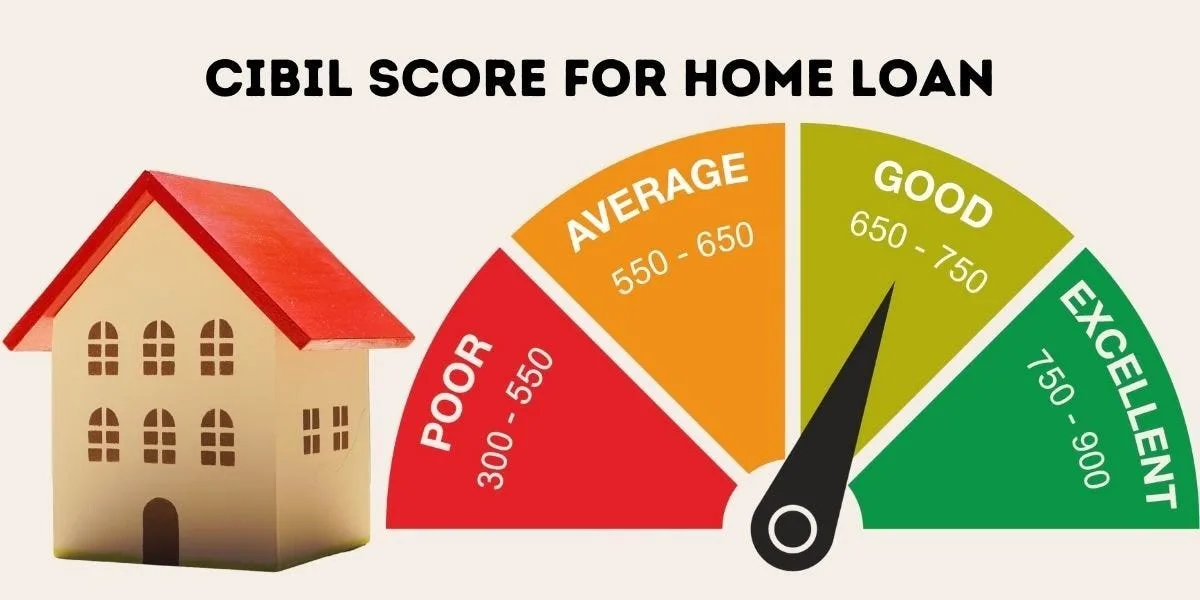

The CIBIL score ranges from 300 to 900. A score between 750 to 900 is considered high and ideal for a home loan.

A high CIBIL score reflects a high ability to handle all types of debt and repay them on time. Therefore, borrowers with CIBIL scores in this range not only experience almost immediate home loan approval but are also able to negotiate loan terms and conditions that make loan repayment easy and entirely stress-free.

How is the CIBIL Score Calculated?

TransUnion CIBIL is the credit information agency that calculates the CIBIL scores and it does so after taking into account several different factors. Let us understand these factors and how they impact an individual’s credit rating.

- Repayment History: Individuals who have always paid loan EMIs and credit card bills on time are considered more reliable and therefore, have a higher CIBIL score than someone who has missed payment due dates often. The impact of missed due dates is stark. Missing a deadline by 30 days can cause an individual’s CIBIL score to drop by almost 100 points and individuals who have defaulted on loan repayment seldom get approved for a loan.

- Credit Utilization Ratio: How you use your credit card also impacts your ability to get approved for a home loan. A high credit utilization ratio establishes excessive dependency on credit and therefore, unreliable credit behaviour. Individuals planning to apply for a home loan must keep their credit utilization ratio below 30% to establish their candidature for the best home loan deals.

- Hard Enquiries: When individuals apply for a loan, the query they make gets registered as a hard enquiry. Too many hard enquiries indicate excessive dependency on credit and therefore, are seen negatively by credit information agencies. Credit users benefit greatly from applying for loans only when they need it.

- Credit Mix and the Age of One’s Credit History: Lastly, the credit mix you have and the number of years for which you have used credit will also impact your CIBIL rating. Maintaining a mix of both secured and unsecured loans and having a clean and long repayment history will work in your favour.

In conclusion, if you are planning to take a home loan, maintain a high CIBIL score by building a clean and long repayment track record, a low credit utilization ratio and a healthy mix of all types of debt.

Let us now walk you through the process to calculate your CIBIL score.

Here’s How to Calculate Your CIBIL Score

If you are planning to avail yourself of a housing loan, make sure to check CIBIL online well beforehand. A CIBIL score below 700 can make it challenging for you to avail a home loan on the most beneficial loan terms and conditions.

If your score does not meet the ideal CIBIL score for home loan requirements, it’s best to delay the home loan application and apply once you qualify.

These days, home loan applicants can check CIBIL online quite easily. If you are okay with paying a small fee to check your score, the most reliable and accurate way of checking your CIBIL score is by going to TransUnion CIBIL’s website and filling out a loan CIBIL score enquiry form.

The fee you will be required to pay will depend on how often you want the credit information agency to send you your CIBIL score. Alternatively, if you do not want to pay a fee, you can check your CIBIL score on one of the many websites that offer this service for free.

To check your CIBIL score on such a website, you will need to share personal details along with your PAN details. Your PAN is unique and is therefore the most ideal way to correctly match you to your CIBIL profile.

The CIBIL score plays a determining role in ensuring home loan approval. Therefore, loan applicants must advance with the home loan application process only if they have the ideal CIBIL score for home loans.